Small- and mid-sized companies that have made considerable strides during the pandemic can further leverage digitilisation to increase their growth, according to Rayna Lesser Hannaway, co-manager of the Oyster US Small and Mid Company Growth fund.

Firms had to adapt during the pandemic as disruption to the global economy accelerated structural trends and has, according to Hannaway, spurred on a new age of e-commerce and evolution of the virtual economy.

“This digital transformation has created a Darwinian landscape, where the strong are getting stronger,” she said.

“In this world, small- and mid-sized companies with bold vision and strong management capabilities have been disproportionate beneficiaries as they take advantage of pandemic-induced shifts.”

The manager added that technological innovations have allowed for companies to tap into previously inaccessible talent pools.

“Increased adoption of digital technology and video conferencing has helped to level the playing field and enabled management to access talent all over the world simply and cost-effectively.”

This can be mutually beneficial and attracts prospective employees by tapping into another structural trend – increased workplace flexibility.

“This structural change enables small-cap firms to compete directly with multinationals – who previously held the advantage by offering access to the world’s capital cities and major hubs,” said Hannaway.

Small-caps and even mid-caps can be an extraordinary source of alpha and the growth potential can be transformational, she suggested.

Hannaway cited Wingstop, a US restaurant chain that leveraged digitilisation to offer customers enhanced value during the pandemic.

Prior to the Covid outbreak, the firm utilised the latest digital innovations and developed a model where most revenue is generated by customers eating outside the store – therefore putting them in an excellent position to adapt to the environment.

“The firm is also led by a management team with a bold, yet robust approach to growth,” she added. “They take a disciplined and tested approach to opening new stores, driven by a long-term vision of becoming a top-10 restaurant brand globally.”

She also spoke of RH, another US company, but one specialising in luxury home-furnishings.

“The firm focuses on creating unique experiences for customers, and with populations mostly confined to being indoors through the pandemic, they have provided a growing customer base with memorable – and crucially – shareable experiences,” she said.

This, she added, minimises marketing and social media budgets as customers essentially market the brand for them through word of mouth.

Oyster US Small and Mid Company Growth’s largest holding is US e-commerce platform Etsy – which focuses on handmade or vintage items - and is a clear example small-cap growth success story.

Share price of Etsy over 1yr

Source: Google Finance

Over the course of a year, Etsy’s share price has gone up 94.68 per cent to $200.47. Although, this figure did hit its all-time high of $244.58 in March. Its market-cap is now more than $20bn.

“Etsy mobilised market participants to overcome a global social problem – the shortage of protective masks,” said Hannaway.

“By empowering market participants in this way, the firm was able to convert many one-off users of the service into fans that frequently return to the platform.”

She added that we have reached a defining moment for well-positioned small- and mid-cap firms, who have the opportunity to narrow the gap between themselves and their large counterparts.

“However, in order to access this small and mid-cap growth potential, investors must be scrupulous and take a long-term approach to firm selection,” said Hannaway.

“Firms at a relatively early stage in their development are more susceptible to volatility in down markets, so it pays to select a concentrated number of firms that are built to last.”

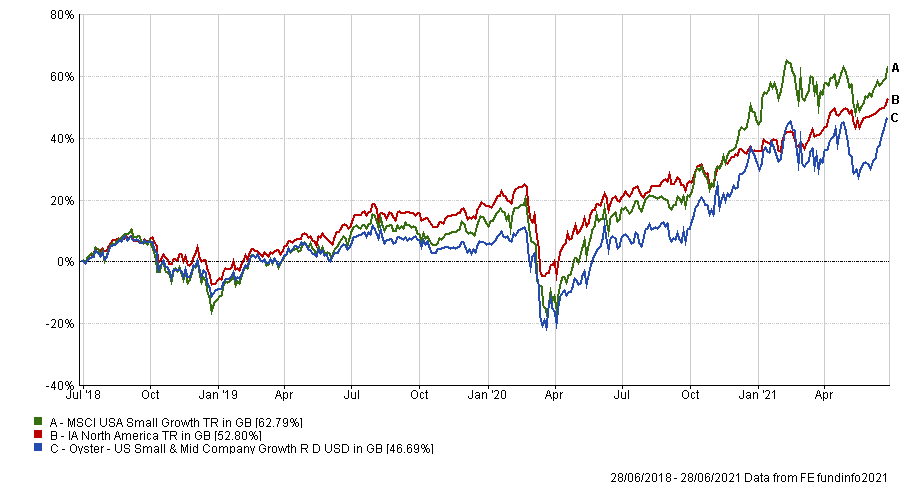

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

The $43m Oyster US Small & Mid Company Growth fund has made a total return of 46.69 per cent over three years, while the average fund in the IA North America sector made 52.80 per cent and its MSCI USA Small Growth index made 62.79 per cent.

Hannaway said the fund looks for firms that demonstrate robust earnings driven by sustainable revenue growth, high returns on capital, proven management behaviours and powerful products or services driven by long-term vision.

“If any of these indicators are absent, the firm presents a long-term risk,” she added. “In a scenario such as a pandemic where most businesses suffer earnings losses, it becomes more difficult to draw comparisons and make long-term projections based solely on the numbers.

“However, assessing the strength of leadership decisions, and how they measure up to the vision becomes critical.

“A crisis acts as a pressure cooker for management behaviours, revealing in a short time how a company interacts with shareholders in periods of stress and market instability and reveals whether the leadership will make long-term growth decisions.”

The fund has an ongoing charges figure (OCF) of 1.54 per cent.