FSSA Greater China Growth, JPM China Growth & Income Trust and Fidelity China Special Situations are some of the names FundCalibre recommends for investors looking to capitalise on the compelling run in Chinese stocks.

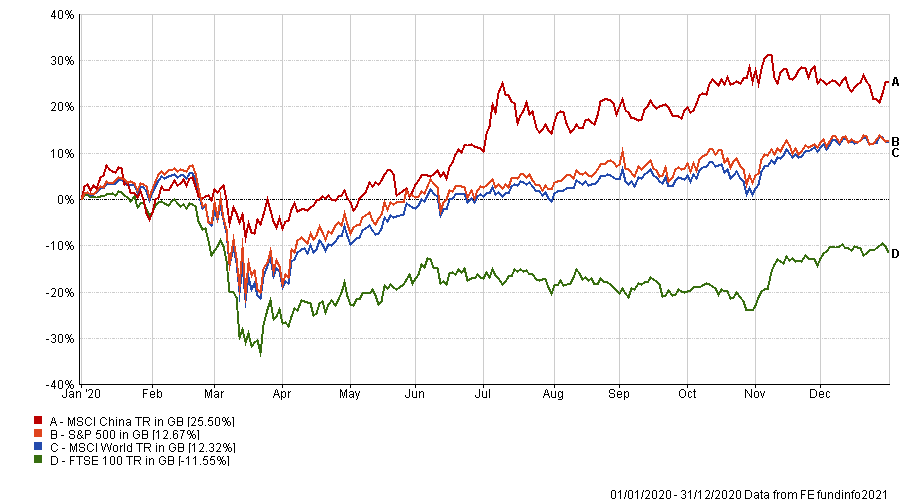

Chinese equities had one of their strongest years in 2020 as the market rallied hard from the country’s overall swift control and recovery from Covid-19. Over at the past year, the MSCI China index outperformed other major indices, including with S&P 500, with a total return of 25.50 per cent.

Performance of MSCI China vs global indices in 2020

Source: FE Analytics

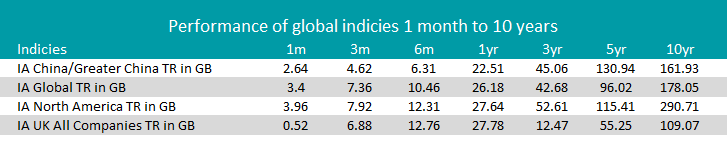

But it’s worth noting that longer term Chinese equities have struggled to match the outperformance of its US rival, despite being similarly high in technology and internet companies.

Source: FE Analytics

“Over the past decade, Chinese equity returns have been overshadowed by those from the US, with the S&P 500 outperforming the MSCI China index in seven of the last 10 years,” said Darius McDermott, managing director of FundCalibre.

He added that although last year had been a strong period for Chinese equities they have dragged in the opening months of 2021.

“But while the average US equity fund has struggled to match the S&P 500 in this time, both the average Chinese equity investment trust and the average Chinese equity fund has managed to outpace the MSCI China index,” McDermott added.

Therefore, looking at the active options FundCalibre highlighted four Chinese equity funds for investors looking capitalise on the sector’s recent strong performance.

Fidelity China Special Situations

The first pick is the £2.2bn Fidelity China Special Situations trust. It is run with a bias to small- and mid-cap companies and tends to own cash-generative Chinese business that are controlled by a strong management team but which are underestimated by the market and are therefore undervalued.

In his latest commentary, manager Dale Nicholls said that China’s “return to normality” could mean fewer risks relative to other economies with higher uncertainties relating to the virus.

He said: “Over 2020, Chinese equities have been one of the best performing asset classes and so valuations are currently not as attractive as they were earlier in 2020. However relative to other markets, such as the US, Chinese stocks continue to trade at a significant discount, with arguably better mid-term growth prospects.”

Some of the stocks Dale has invested in to capitalise on this include pharmaceutical firm Wuxi Apptec and Skshu Paint, a paint manufacturer and one of the main contributors to the fund’s recent performance.

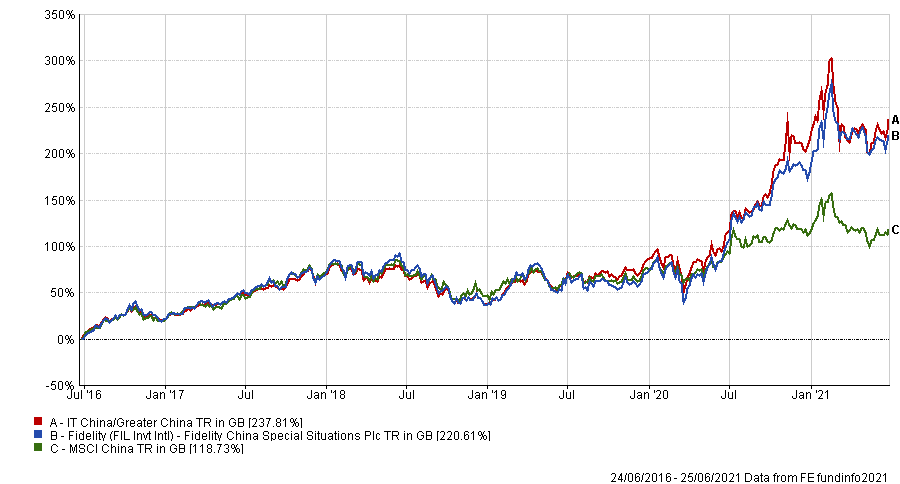

The Fidelity China Special Situations trust is one of three funds in the IT China/Greater China sector.

Over the past five years it’s underperformed the sector’s average return (237.81 per cent) but outperformed the MSCI China index (118.73 per cent).

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

Currently the trust is at a 2.6 per cent discount with 26 per cent gearing. It has a dividend yield of 1.1 per cent and ongoing charges of 0.97 per cent.

JP Morgan China Growth & Income Trust

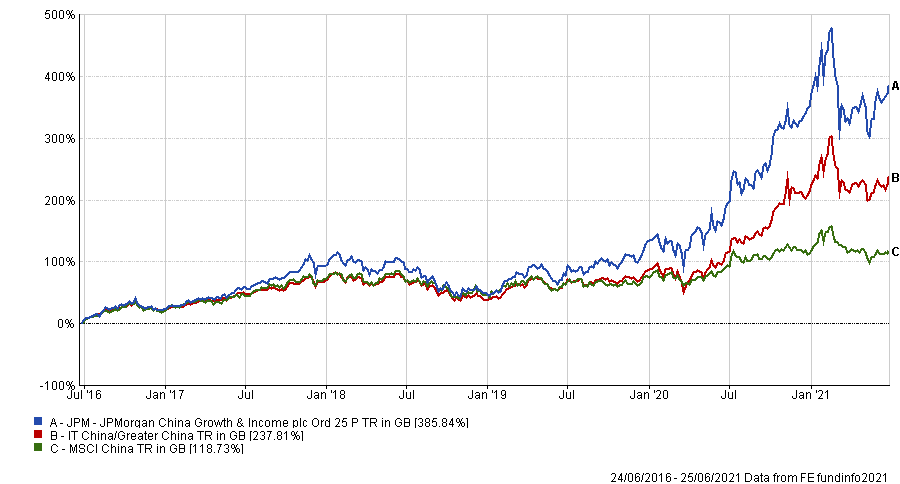

Next is another member of the IT China/Greater China sector: the JP Morgan China Growth & Income trust. This trust, however, was the top performer over five years with a return of 385.84 per cent.

Launched in 1993, the trust – which is managed by Howard Wang, Shumin Huang and Rebecca Jiang - invests in Chinese companies linked to the growth of ‘New China’ –the transition of the country to a more consumer-driven economy.

As mentioned above the fund has outperformed its sector peers as well as the MSCI China index (118.73 per cent).

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

Holding an FE fundinfo Crown rating of four, JPM China Growth & Income Trust is currently running at a 2.2 per cent premium with 8 per cent gearing. It has a dividend yield of 3.2 per cent and ongoing charges of 1.01 per cent.

FSSA Greater China Growth

FundCalibre’s next fund pick is FSSA Greater China Growth. The research agency said FSSA Investment Managers - which is an independent investment management team within First Sentier Investors - is “[a] well-managed businesses with good corporate governance across Hong Kong, China and Taiwan”.

In a recent conversation with FundCalibre, FE fundinfo Alpha Manager Martin Lau said that he was expecting more balanced market growth for the remainder of 2021.

“As the economy recovers, shares in a wider range of sectors will become more attractive,” he said.

“Last year, just a handful of companies accounted for the majority of the returns. We have already started to see signs of change, hence why we expect this year to be different from the last.”

Applying a bottom up investment approach, Lau and co-manager Helen Chen are focused on four main themes for opportunities: dominant consumer franchises, high quality financials, rise in healthcare spending and a connected and automated world.

A mid- to large-cap focused strategy, its biggest holding is Taiwan Semiconductor (8.3 per cent) while other well-known names in the top 10 include Merchants Bank and Realtek Semiconductor Group.

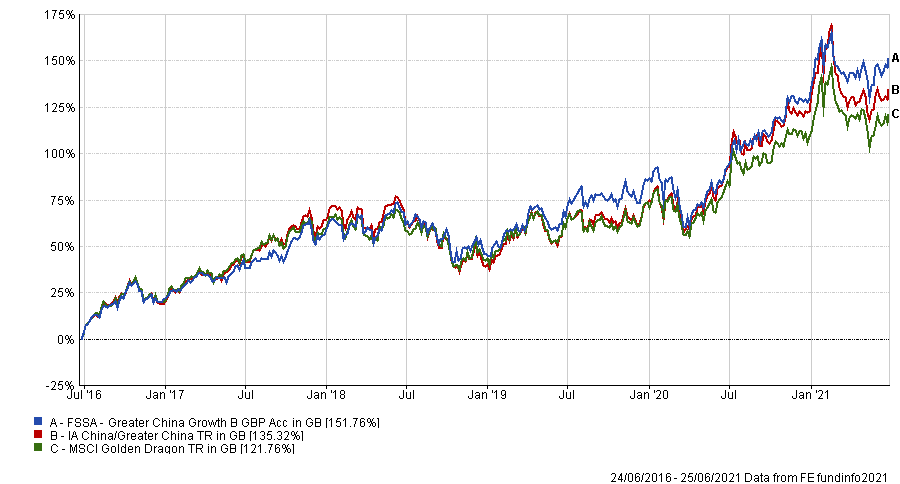

FSSA Greater China Growth has made a total return of 151.76 per cent, outperforming both the IA China/Greater China and the MSCI Golden Dragon index over five years. It was the 10th best performer overall in the IA China/Greater China Sector for that timeframe.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

Source: FE Analytics

Holding an FE fundinfo Crown Rating of four, it has an ongoing charges figure (OCF) of 1.07 per cent.

Invesco China Equity

The final pick is the £496.7m Invesco China Equity fund. Investing with a bias to mid-cap sized companies, the fund has recently increased its exposure to the Chinese A Share market for investment opportunities, FundCalibre said.

The fund’s managers, Lorraine Kuo and Mike Shiao, run a bottom-up process, taking a high conviction approach with companies they feel have both sustainable leadership and competitive advantages and are operating a discount to what they consider is ‘fair value’.

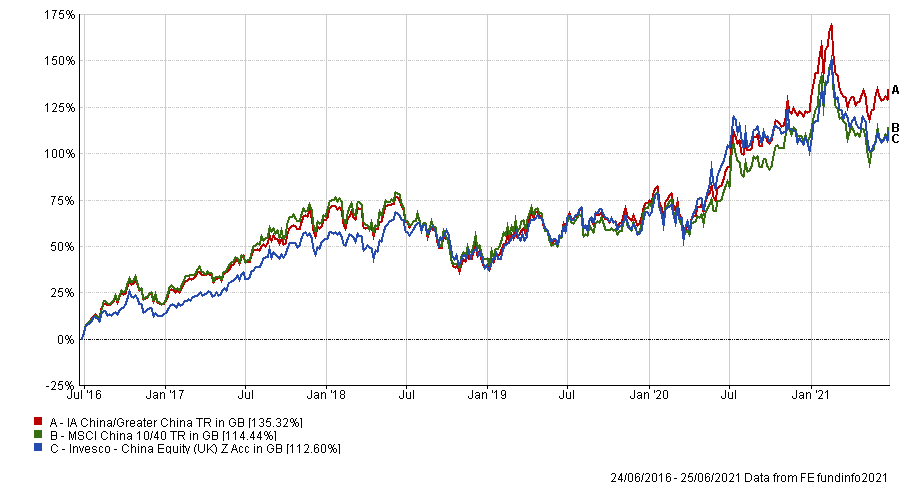

Over five years it’s made a total return of 112.60 per cent, underperforming both the sector and MSCI China 10/40 index.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

Invesco China Equity has an OCF of 0.94 per cent.