More than ever, it is difficult to predict the progress of the European economy over the next few years. Of course, following its recent double-dip recession, economic activity is likely to enjoy a strong rebound as the region accelerates the rollout of its vaccination programme.

As is already the case in the US, pent-up demand is expected to drive a material recovery in consumption across Europe in H2 2021, broadening a rebound which has so far been more limited to manufacturing and exports. Although contingent upon the ongoing roll-out of effective vaccines, such an outcome, along with higher inflation, is relatively easy to predict.

More difficult is assessing what happens following the initial rebound, both in terms of the recovery’s staying power and whether its associated inflationary pressures prove to be transitory.

For example, will structural obstacles, in the form of ageing populations, job insecurity and an excess of debt, prevent a dynamic and long-lasting period of European economic growth? If there is to be a Roaring Twenties, will Europe be invited to the party? Or should we acknowledge the extent to which global purchasing power is decidedly pivoting towards Asia, with 85 per cent of the world’s middle-class growth stemming from the region by 2030?

As long-term investors we think it is better not to rely upon a strong economy even if we welcome a recovery. The attractiveness of Europe is the strength of its leading companies and their ability to thrive without depending upon a dynamic economic backdrop.

We have long argued that the European region is a rich hunting ground for stock pickers in search of category leaders which have a long track record of successfully navigating a variety of contrasting economic circumstances.

In our view it is also an unfashionable zone as many global equity investors are instead drawn to the US for its technology winners or Asia for its economic dynamism. We believe this lack of crowdedness adds to Europe’s attractiveness, particularly when enough of its companies clearly lead the world in those end-markets where the demand drivers are structural, underpinned by megatrends which are so much more predictable than the ups and downs of the economy.

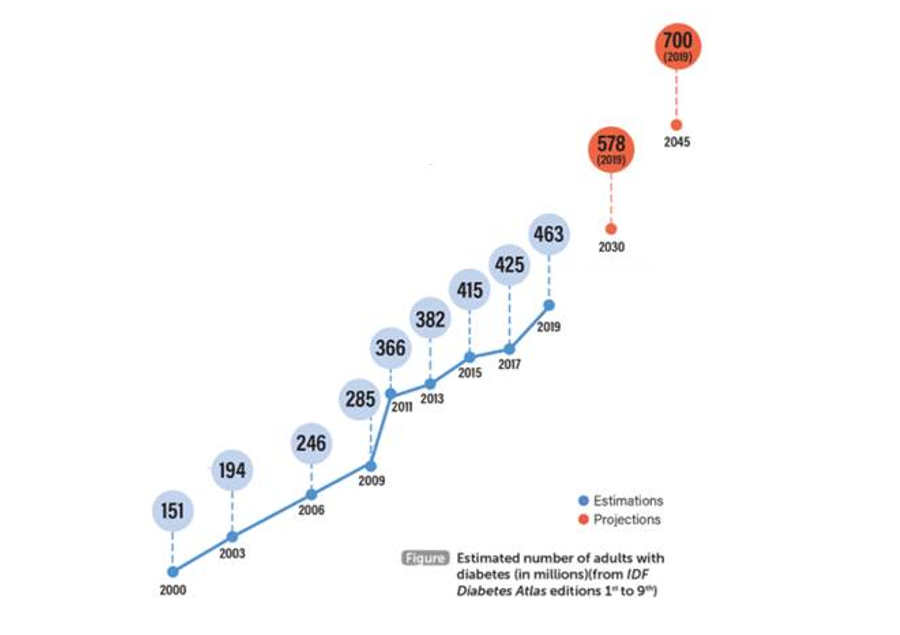

It is why, for example, we invest in a healthcare company active in diabetes-care, a chronic and increasingly prevalent condition where market leadership relies upon improving treatments, as well as better patient access to these treatments.

Diabetes rising worldwide and set to rise further

Source: IDF Diabetes Atlas

We are in no mood to compromise on the quality of our European investments. Sustained rebound or not, we believe company success will instead be defined by the ability to serve customers who will insist upon ever-improving products and services which are differentiated by their desirability, reliability and value-for-money - and by evidence that they have been sourced or produced ethically and responsibly. Economic and commercial progress must be compatible today with preserving the biodiversity of the planet as well as keeping a lid on global warming.

We are convinced that it will be the most innovative and financially strong companies which will be best equipped to rise to this challenge. Europe boasts more than its fair share of global companies with the far-sighted ambition to apply their capabilities to meeting the exacting demands of their customers, shareholders, and wider communities.

A ruthlessly meritocratic approach to investing in Europe’s listed companies runs the risk of behaving like a party-pooper. The Roaring Twenties will pass these companies by, or so runs the argument. Short term this refrain does not lack validity, particularly as far as share prices are concerned. But many of these strong companies were evidently in the line-of-fire at the height of the crisis last year and are already benefitting from the recovery in China and the US.

We believe it will be the companies which enjoy category leadership, and market shares which have risen during the crisis, which are best positioned to capitalise upon a recovery.

P&L latitude and financial strength enabled many of these strong companies to stand by their workforces, customers and suppliers at the nadir of last year’s economic collapse, meaning that their ecosystems will be at full-strength and ready to participate in a recovery at a time when many of their competitors have compromised the loyalty of their customers and the integrity of their supply-chains.

Today’s shortages and bottlenecks, characterised by rising input costs, are a reminder of the importance of both purchasing and pricing power. In our opinion robust balance sheets and superior access to low-cost debt will also equip Europe’s strongest companies with the firepower to lead their industries into the recovery while also providing protection against higher interest rates and/or the surprise of another economic downturn. Moreover, structural growers are less likely to be up against elevated high-watermark comparisons come 2023 and 2024.

Often backed by founding families or foundations, many European companies continue to play the long game. Their prioritisation of innovation and customer satisfaction will define their progress in the years and decades to come, as will the importance of their legacies, both economic and environmental. As European equity investors, we have many reasons to be optimistic about the future.

Rory Powe is manager of the £1.7bn Man GLG Continental European Growth fund. The views expressed above are his own and should not be taken as investment advice.