European equity funds managed by the likes of Barings, BlackRock and Comgest could be good starting points for investors looking to build exposure to the continent, according to Fidelity Personal Investing’s Toby Sims.

Sims argued that many UK investors appear to ignore European equity strategies, as Europe lacks the technology-driven growth giants that have led US and Chinese markets or the familiar UK cyclical names that are starting to come into their own.

However, he added: “None of that means you should ignore the region. There are myriad opportunities here, many of which go overlooked by the wider market.

Performance of regions in 2021 (in local currencies)

Source: FE Analytics

“As of the end of May, European shares have been the best performers among major markets since the start of the year. A low starting platform - Europe’s shares have been out of favour since the sovereign debt crisis - could combine with a post-pandemic recovery to offer investors a new trove of opportunities.”

Below, Sims highlights five European equity funds that investors could consider for their portfolios.

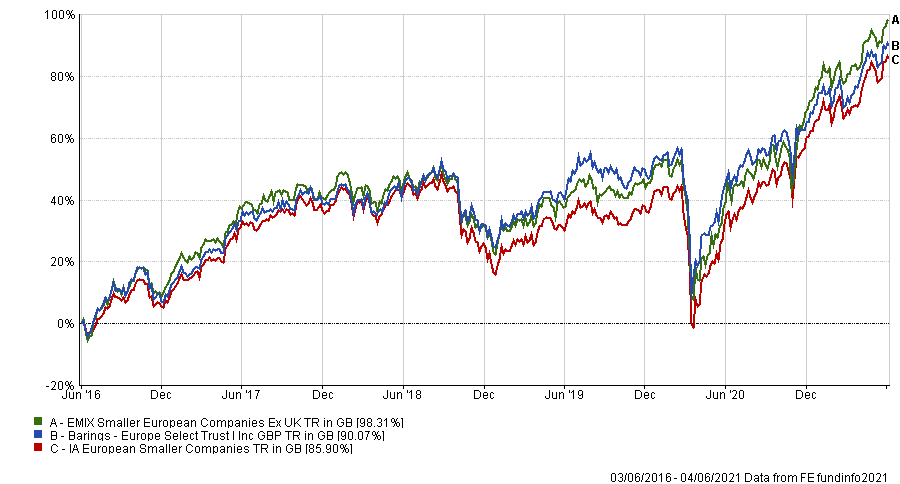

Barings Europe Select Trust

The first fund highlighted by Sims is Nick Williams’ £1.4bn Barings Europe Select Trust, which resides in the IA European Smaller Companies sector. He noted that Williams believes small European stocks go under many analysts’ radars, creating opportunities for active managers.

“For investors looking to smaller caps as a route into Europe’s domestic trends, this fund could be one to consider. It would also work well alongside a larger-cap focused fund to gain well-diversified exposure to the region,” Sims added.

“Williams is very much a bottom-up investor. He wants to understand individual businesses on a fundamental level to seek out any mismatches between price and value. He’s ably supported by a wider management team consisting of Colin Riddles, Rosemary Simmons and William Cuss.”

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

Of course, smaller companies – while offering the potential for greater growth than large-caps – can be a riskier proposition and have more exposure to the domestic economy, making them more vulnerable in times of economic instability.

However, Sims pointed out that the fund’s management team concentrates on finding high-quality businesses with above average profitability and defensive business models in order to mitigate this.

Barings Europe Select Trust has an ongoing charges figure (OCF) of 0.80 per cent.

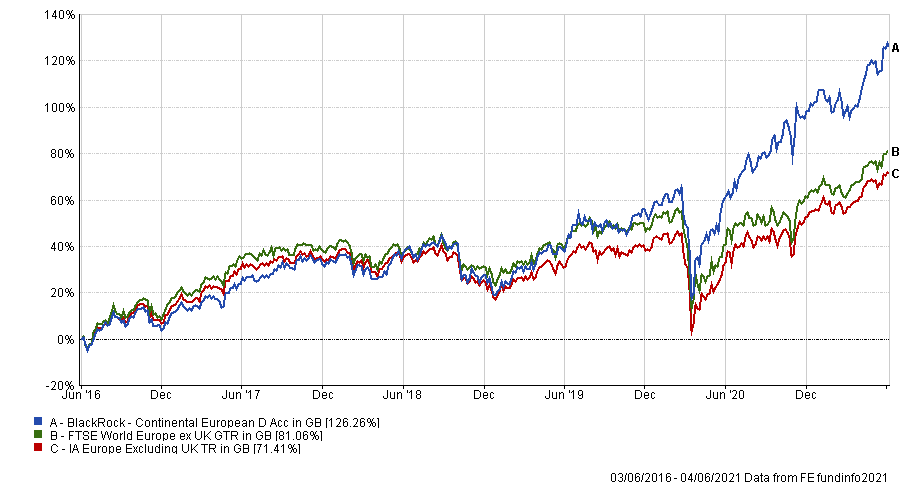

BlackRock Continental European

The £941m BlackRock Continental European fund comes next. Sims described this as a defensively minded fund that is looking for businesses that can grow in any economic environment.

“For managers Stefan Gries and Giles Rothbarth, a good mark of the defensive qualities they’re looking for is predictability,” he explained.

“They’re looking for companies that offer reliable earnings and cash-flow trajectories. Businesses with clearly defined strategies, competent management teams and strong levels of cash generation that can be reinvested into future growth are all attractive.”

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

However, investors should be aware that the fund is managed with a long-term focus and its preferred stocks can lag when cyclical areas like energy or financials are rallying.

But Sims added that some of the upsides of the fund include the prospect of “a relatively steady ride and meaningful growth opportunities along the way”.

BlackRock Continental European has a 0.92 per cent OCF.

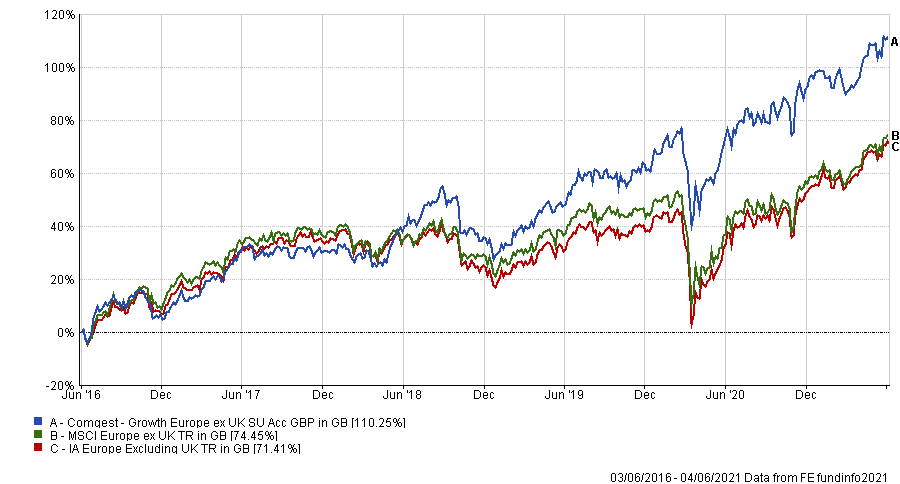

Comgest Growth Europe ex UK

Fidelity’s third picks is Comgest Growth Europe ex UK, where manager Alistair Wittet is seeking quality-growth companies with high barriers to entry, strong returns and sustainable growth prospects.

Comgest has a strong culture of long-term investing, which is re-enforced by the firm’s partnership structure that makes all managers shareholders in Comgest. Wittet agrees that this allows managers to maintain a long-term focus, rather than be distracted by short-term noise.

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

“This long-term approach is at the heart of everything Wittet and his team do. The fund has only ever held 140 different companies since the launch of Comgest’s pan-European strategy 30 years ago,” Sims added.

“That means that the managers take high-conviction positions in a concentrated portfolio of stocks. They currently hold 37 companies, with the top 10 positions accounting for 43 per cent of the total portfolio. Investors should note that a concentrated portfolio like this may be riskier than one diversified over more holdings.”

Growth-focused sectors like technology and healthcare feature heavily in the portfolio and the fund has never held a single bank, commodities, utilities or oil & gas company, which are typical value stocks.

Like BlackRock Continental European, this is another fund that might fall behind during times when the economy is strong. However, Sims argued that it could outperform when markets are weak and suit investors with a long-term horizon.

Comgest Growth Europe ex UK has an OCF of 0.93 per cent.

JOHCM European Select Value

The previous two funds were followers of the growth style of investing, which has performed very well for the bulk of the past decade but has been struggling over the past six months as the ‘reopening trade’ favoured value sticks. JOHCM European Select Value, Sims’ fourth pick, is in many ways a typical value fund.

Explaining how the fund combines ‘quality value’ and ‘deep value’, he added: “For portfolio manager Robbie Woulters and his deputy Luis Fananas, that means holding a combination of ‘great companies at average prices’ and ‘average companies at great prices’.

“The former consists of highly profitable companies with consistent and transparent earnings growth; the latter lower quality businesses possibly facing near-term headwinds but hopefully able to offer an attractive upside in the longer term.”

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

However, what differentiates the fund from most value strategies is the fact Woulters does not rely on traditional valuation measures and instead focuses on free cash flow yield. This means the portfolio is light in financials and energy stocks, which are often a mainstay of value investing.

“For investors looking for a different approach to European equities, and who are willing to tolerate bouts of price volatility, this fund makes for an interesting choice,” Sims said.

JOHCM European Select Value has a 0.79 per cent OCF.

Fidelity European Growth

The final option for investing in the continent is the €6.9bn Fidelity European Growth fund, which is another quality-growth strategy. Manager Matthew Siddle tends to prefer companies with high cash flow returns on investment, strong balance sheets and steady earnings growth.

“This quality-growth bias draws the manager to certain sectors over others. Consumer staples, health care and information technology make up much of the portfolio. Conversely, it is underweight materials and utilities,” Sims said.

“Though a traditionally value-orientated sector, Siddle’s exposure to financials demonstrates his valuation discipline - here the manager currently prefers insurance stocks, like top 10 holdings Legal & General and Prudential, over banks due to their record-low valuations despite fundamentals holding up and improving pricing.”

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

Sims finished that the fund’s quality-growth focus and decent levels of diversification across sectors mean it could be a good core holding for portfolios. While it “may not shoot the lights out in rapidly rising markets”, Fidelity thinks it could offer meaningful levels of growth over the long term.

Fidelity European Growth has a 1.04 per cent OCF.