Funds that invest in areas such as gold, India and UK equities handed their investors the best returns in May, FE fundinfo data shows, while a stronger pound caused non-UK funds to stutter.

Last month contained some good news for investors as the UK’s vaccination programme progressed at a steady pace and optimism on the strength of the post-pandemic economy continued to improve, with the Bank of England forecasting GDP growth of 7.25 per cent for 2021.

However, the emergence of the Indian coronavirus variant (which the World Health Organization will call the ‘Delta’ variant in its new naming system) and its rapid spread in England cast a shadow over the good news, with some calling for the country’s re-opening plans to be put on pause.

A similar mixed picture was seen on the international stage, meaning that May was a relatively lacklustre month for markets. The MSCI AC World index posted a 0.9 per cent fall in sterling terms (this was down to the strength of the pound; in local currency it was up 1.1 per cent).

The FTSE All Share also gained 1.1 per cent last month, but one of the biggest winner was gold with the S&P GSCI Gold Spot index notching up a 5.1 per cent rise. Government bond markets were relatively calm, with the yields on the US and UK 10-year falling slightly.

Ben Yearsley, director at Fairview Investing, said: “It felt like a consolidating month for markets. Not much happened. Decent results from various companies, vaccinations continuing, upgrades to the growth outlook and some welcome dividends from a few heavyweights, especially in the financial sector.

“Oh, and sterling continues the strong 2021 taking the shine off a bit for investors with globally diversified portfolios.”

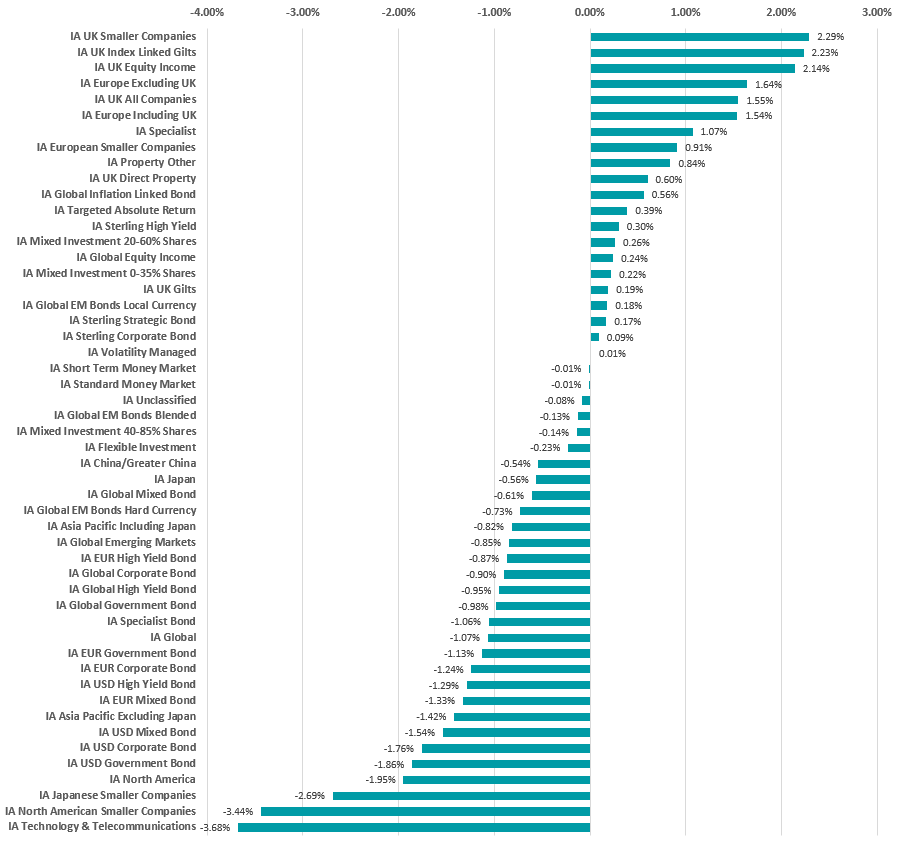

Performance of fund sectors – May 2021

Source: FE Analytics

The above points are reflected in the average returns of the various Investment Association fund sectors, which can be seen in the bar chart above.

UK-focused sectors account for four of the five highest-returning peer groups last month, with IA UK Smaller Companies leading the way with an average gain of 2.29 per cent.

Expectations of a stronger UK economy would favour smaller companies, but it was also a good month for the IA UK Equity Income and IA UK All Companies sectors as well, demonstrating a revival in interest after several years of the home market being overlooked by investors.

May was also a strong month for European equities, while the US, tech and Japanese smaller companies struggled. The average IA Global fund was down just over 1 per cent last month.

However, Yearsley added: “If commodities had their own sector, like they do in the investment trust world there wouldn’t have even been a contest. For the record in the trust universe, the IT Commodities & Natural Resources sector took top spot with a rise of 9.02 per cent.”

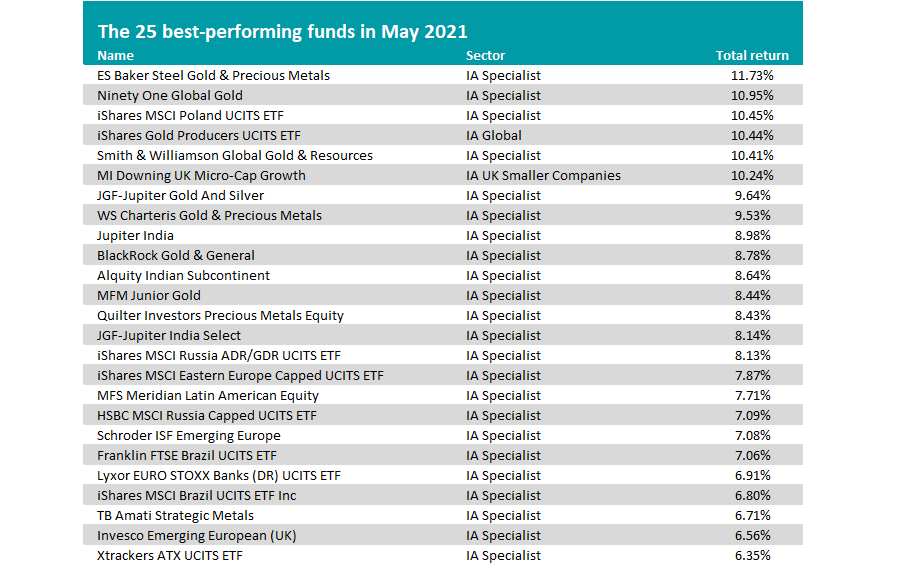

Source: FE Analytics

We can see this point in the best performing individual funds, with gold strategies dominating the monthly performance tables. Six of the 10 best performers in May focus on gold and precious metals, reflecting the $128 rise in the gold price during the month (taking it to $1,905 per troy ounce).

ES Baker Steel Gold & Precious Metals, Ninety One Global Gold, iShares Gold Producers UCITS ETF and Smith & Williamson Global Gold & Resources all made total returns of more than 10 per cent – in a month when high returns seemed in short supply.

The only other funds out of the 4,800 in the Investment Association universe that were up more than 10 per cent in May were iShares MSCI Poland UCITS ETF and MI Downing UK Micro-Cap Growth.

Decent performance from Indian equities is another theme from May, as markets followed their recent trend of moving higher before the end of a local Covid wave, Yearsley noted. India’s Nifty 50 closed at a record high last week.

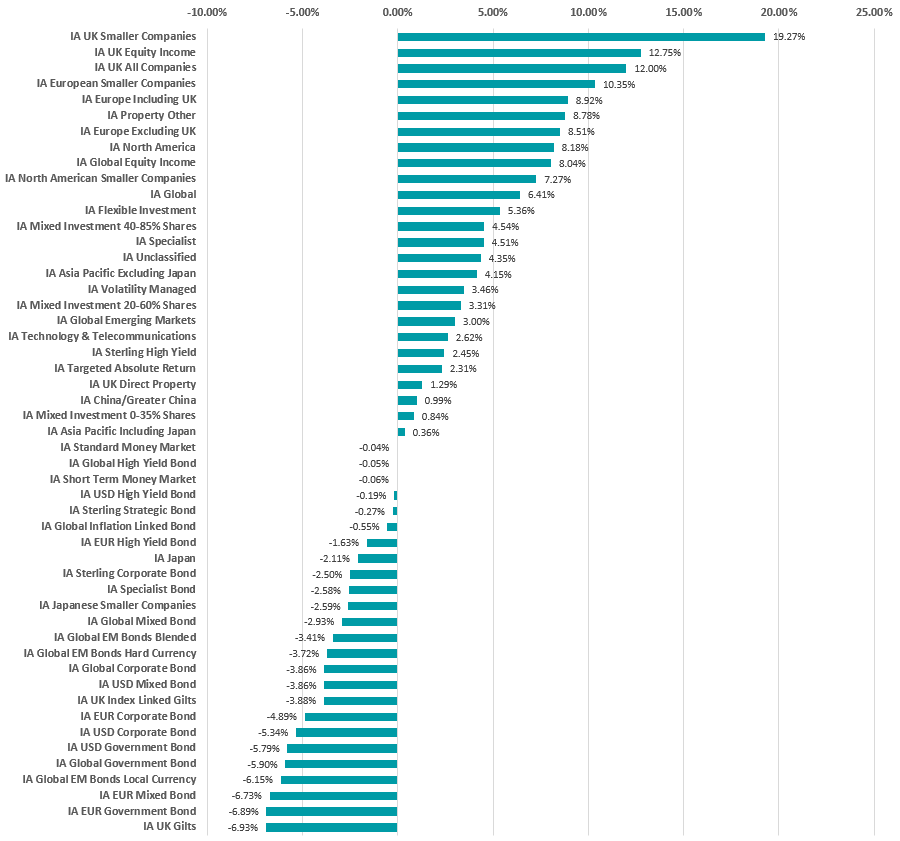

Source: FE Analytics

A look at the weakest funds confirms how the rotation away from growth stocks and towards value continued to play out for another month.

During May, more cyclical or value sectors like energy, financials, materials and industrials made positive returns while growth areas like technology were hit with losses.

When it comes to individual funds, this meant that many of last month’s worst performance focused on the US or technology. Many of the funds that appear in the above table have very strong long-term track records but have struggled since November’s announcement of Covid vaccines sparked a change in market leadership.

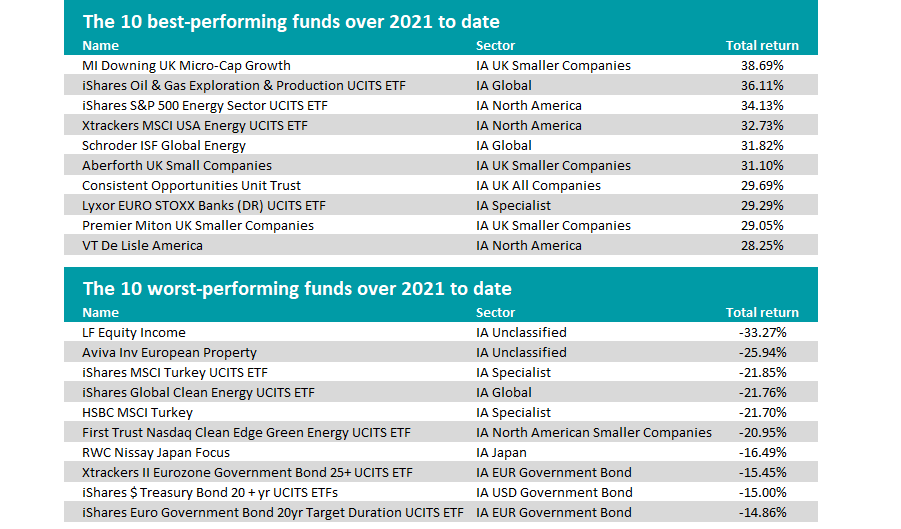

So, how does this leave the 2021 to date performance rankings looking?

The chart and tables below show how previously unloved areas like UK equities and energy continue to outperform their peers while heavy losses have been sustained in some corners of the market.

Performance of fund sectors –2021 to date

Source: FE Analytics