Investors spurning bonds should focus less on their low yields and more on their potential as a portfolio diversifier for the uncertain times ahead, according to Tony Carter, fixed income manager at Sarasin.

Carter noted that bonds have played an integral role in investors’ portfolios for well over 100 years and were considered the asset class to own “before equities threw off their mantle of being a high-risk gamble”.

“Historically, they have produced a return better than cash and time and time again they have proved to be a liquid safe haven in times of market stress,” he said.

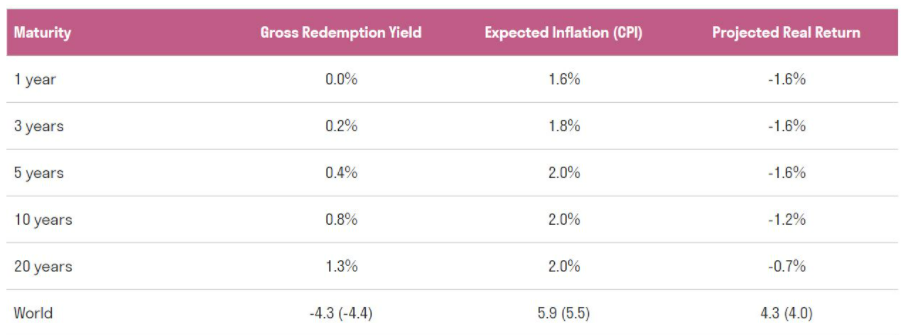

“However, after decades of falling inflation and ever lower bond yields, we have reached a point where the majority of investors are projecting that the low returns available on government bonds will be more than offset by inflation, resulting in negative ‘real’ total returns.”

This has caused them to ask whether now is the moment to abandon gilts and investment grade bonds altogether. Carter thinks this would be a mistake.

“There is no getting around the fact that these [yields] are extremely low, absolutely and by historical standards,” he continued. “Take off inflation and an estimated cost of management and the results are likely to be negative.

“The case against owning bonds look persuasive.”

Total return on government bonds if held to maturity

Source: Bloomberg & Sarasin

However, this is under the assumption that the bonds are held to maturity.

The manager said it is likely that at some point in the next decade, confidence in other assets will crumble and there will be a classic flight to safety. This could drive bond yields lower and prices higher, which is what happened in the first half of 2020.

Gilts produced a return of 6.4 per cent in Q1 of 2020 even though the GRY (gross redemption yield – the income yield plus the capital gain or loss if held to maturity) on the 10-year instruments started the period at just 0.8 per cent.

Carter added that this was against a backdrop of global equities falling by 16 per cent and UK equities falling by 25.1 per cent.

“Alternatively, forecasts for growth and recovery might be optimistic or central banks and governments might pursue even more draconian measures of financial repression,” he said.

Bond yields, he added, could turn negative as they have in Europe, and if the 10-year gilt moved from today’s yield of 0.79 per cent to -0.25 per cent over the next 12 months, the total return would be 8.6 per cent.

“So, there are scenarios that would result in bonds producing attractive absolute returns and there will almost certainly be periods when gilts dramatically outperform other asset classes, even if only for brief moments in time.”

He noted that investors can get more than the sub-1 per cent GRY on 10-year UK government issues by owning corporate bonds.

“We typically suggest a 50:50 split between government and corporate issues, which can be tactically skewed to favour one over the other depending on your outlook,” Carter said.

He added that for investors with short- to medium-term time frames, gilts and high-quality corporate issues should continue to play an important role in their portfolios.

“The inherent risk in most other asset classes will remain too much to bear,” he said. “Low returns are a bitter pill to swallow, but being forced to sell volatile assets after a sharp unexpected setback is probably even less palatable.”

He said for longer-term investors who are happy to forego a little return to achieve less volatility, UK government and corporate bonds remain a key diversifier.

“First, their risk-return profile has changed absolutely and relative to other asset classes,” said Carter. “Second, we are more comfortable with the other asset classes and techniques at our disposal that we can deploy to dampen volatility when compared with 10 years ago.

“In short, government and high-quality corporate issues have less unique safety characteristics than they used to.”

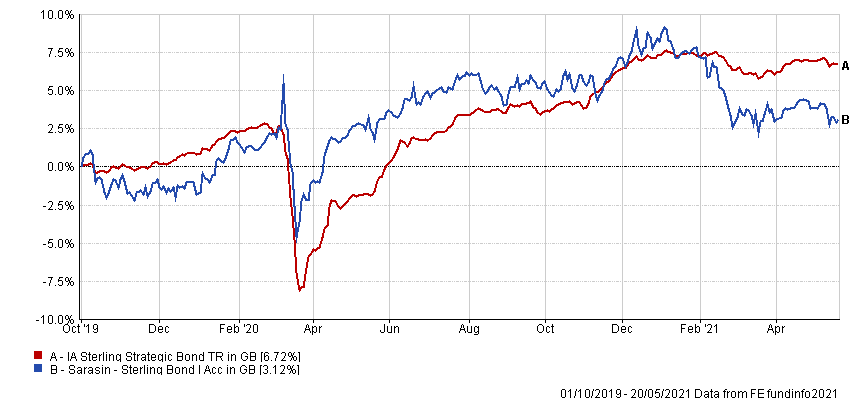

Performance of fund vs sector over manager’s tenure

Source: FE Analytics

Data from FE Analytics shows Carter’s Sarasin Sterling Bond fund has made 3.12 per cent since he took charge in October 2019, compared with 6.72 per cent from its IA Sterling Strategic Bond sector.

It is £115m in size and has ongoing charges of 0.71 per cent.