The past few months have seen a turnaround in the UK market’s performance and popularity, so Trustnet asked investment experts which portfolios would be ideal if this UK surge continued.

The UK market is weighted more towards the value and cyclical industries that lagged global peers during the years of low interest rates and loose monetary policy. These also saw some of the biggest hits during the immediate Covid-19 sell-off.

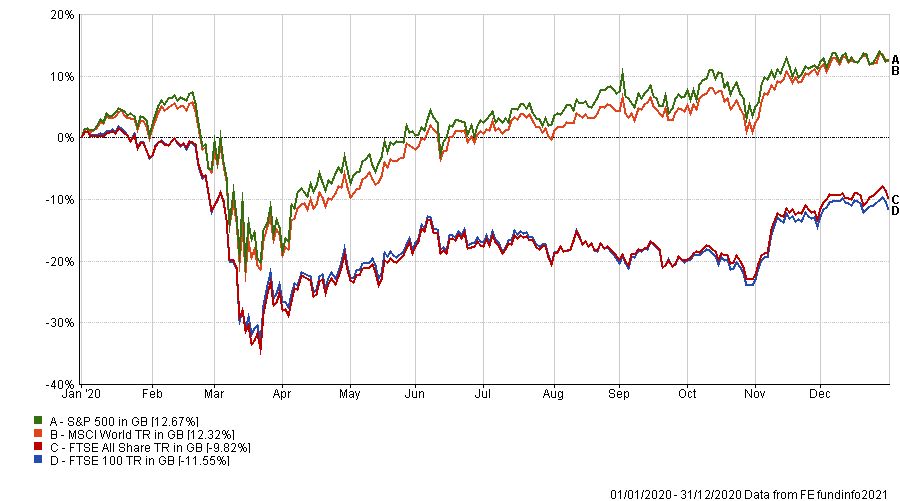

Performance of UK vs global indices in 2020

Source: FE Analytics

All of this was overcast by lingering Brexit concerns, which kept some international investors away from the UK.

But the rollout of several effective Covid-19 vaccines last year triggered a rotation into value, as investors priced in an economic recovery. When combined with a Brexit trade deal, this meant the UK entered 2021 on a positive note.

Indeed since ‘Pfizer Monday’, UK indices have outpaced other markets, indicant of the pro-cyclical rally occurring.

Performance of UK vs global indices since November 9 2020

Source: FE Analytics

Looking at the latest fund flow data and the positive sentiment from investors towards the UK is clear, according to the Calastone Fund Flows Index (FFI).

Calastone found that while the majority of April’s fund flows went into global equity portfolios (£576m), UK equity funds enjoyed £303m worth of inflows, making it the third consecutively positive month for the UK.

“In the last three months, a turnaround in sentiment towards the UK means UK equity funds have recouped all the outflows from the previous six,” Calastone added.

Below, market experts provided their UK portfolio recommendations.

Ninety One UK Special Situations

Ninety One UK Special Situations is well placed to take advantage of the reopening trade and benefit from the a strong macroeconomic bounce back, according to Juliet Schooling Latter, FundCalibre’s research director.

It invests in businesses which took some of the biggest hits in the pandemic, such as housebuilders, airlines/holiday companies, autos, builders’ merchants and banks. These are also the assets Schooling Latter thinks could be ideal for the economic reopening.

She said the Ninety One UK Special Situations fund “is one of the true value funds left”.

Managers Alessandro Dicorrado and Steve Woolley believe out of favour companies are rarely out of favour permanently and can still generate strong returns when they’re rehabilitated, Schooling Latter explained.

The fund made a total return of 39.42 per cent over five years, underperforming the IA UK All Companies sector (44.60 per cent) and the FTSE All Share index (42.62 per cent).

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

The fund has an ongoing charges figure (OCF) of 0.87 per cent.

River and Mercantile UK Recovery

Next is the River and Mercantile UK Recovery fund.

Run by Hugh Sergeant since launch in 2008, the fund has made top quartile returns over several time frames: year-to-date, three months, six months, one year, five years and 10 years.

Dzmitry Lipski, head of funds research at interactive investor, explained that Sergeant has achieved this by focusing on good businesses that are currently experiencing below-normal profit levels, which are depressing their valuations.

“To warrant inclusion in the portfolio, a company must have capabilities to help itself out of this predicament,” Lipski said.

Over five years it’s made a total return of 79.03 per cent, outperforming both the IA UK All Companies sector and MSCI United Kingdom index (39.38 per cent).

It has an OCF of 1.14 per cent.

Aberdeen Standard Equity Income

“If you think the UK recovery will continue – and there are certainly some encouraging signs given the success of the vaccine roll out – then you will probably want to target small and medium-sized companies as these tend to be more domestically-exposed,” said Rob Morgan, Charles Stanley Direct’s pension and investment analyst.

His pick is the £207.23m Aberdeen Standard Equity Income investment trust, which can ‘nimbly’ invest across the multi-cap space.

The trust has undergone “an exceptionally difficult period” as UK domestic companies struggled in comparison to international earners and then suffered the massive economic impact of Covid.

“But it’s well placed to capture any sustained rotation into UK earners that takes place. […] It’s already had a decent turnaround since the start of the year, but there could be further to go if economic data continues to improve,” Morgan added.

Indeed year-to-date it’s the sixth best performer in the IT UK Equity Income sector.

Over five years the trust made a total return of 14.64 per cent, underperforming both the IT UK Equity Income sector (44.69 per cent) and the FTSE All Share index (42.62 per cent).

It has a 5.6 per cent dividend, running at a 5.1 per cent discount with 9 per cent gearing. It has ongoing charges of 0.87 per cent.

Man GLG UK Undervalued Assets

The next pick comes from Fairview Investing co-founder and director Ben Yearsley, who said that if an investor is looking for a UK portfolio now “it’s got to be a recovery or undervalued assets fund of which there are several worthy candidates to choose from.

“My suggestion is Man GLG UK Undervalued Assets managed by Henry Dixon,” he said.

“I spoke to Henry Dixon a month or so ago and he said the current situation was the most optimistic he had been and that the backdrop was ridiculously good. He’s been buying companies that haven’t wasted the crisis.”

Managers Dixon and Jack Barrat focus on two types of companies, ones which are cheap on an asset basis and those undervalued on P/E metrics.

The £1.3bn fund outperformed both the IA UK All Companies sector and the FTSE All Share over five years with a total return of 42.62 per cent.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

Man GLG UK Undervalued Assets has an OCF 0.90 per cent.

Fidelity Special Situations

Next up is the £2.9bn Fidelity Special Situations fund, which Jason Hollands of Tilney Investment Management Services said is one of his “top picks” for the current UK environment.

Run by FE fundinfo Alpha Manager Alex Wright and Jonathan Winton, the fund’s investment opportunities typically fit into four categories: companies that have performed poorly but are implementing turnarounds; growth companies on relatively low valuations; companies that have divisions that are hidden jewels whose potential is not fully recognised by the market; and businesses with an above average chance of being involved in takeovers.

“Wright looks for stocks that are below the radar of the wider market and are somewhat unloved but with the scope to be re-rated,” Hollands said.

The Fidelity Special Situations fund made a return of 43.46 per cent over five years, outperforming its FTSE All Share benchmark but underperformed the IA UK All Companies peers.

It has an OCF of 0.91 per cent.

Artemis UK Select

The final fund pick focuses on areas the UK market is most known for - mining, energy and industrials - but could “remain the key beneficiaries of the latest post-Covid recovery,” according to Peter Toogood, chief investment officer at The Adviser Centre.

He highlighted the £1.2bn Artemis UK Select fund as “a more value-orientated tilt [that] would fit the bill.”

Managers Ambrose Faulks and Ed Legget used the March sell-off to buy into new opportunities “and it bore significant fruit in the recovery”, Toogood said.

“[They] remains pro-recovery and value-orientated in his stock selection but is alive to the multiple economic paths in front of us and will reflect that in the portfolio as the year progresses.”

The fund is currently top quartile over all time frames: year-to-date, three months, six months, one year, three years, five years and 10 years.

Over five years Artemis UK Select made a total return of 73.17 per cent, outperforming both the sector and benchmark.

Performance of fund vs sector and benchmark over 5yrs

Source: FE Analytics

It has an OCF of 0.94 per cent.