Exchange-traded funds (ETFs) that concentrate on parts of the market that are surging have generated returns far higher than their active rivals in 2021’s re-opening rally, Trustnet research shows.

Strong progress in the Covid-19 vaccination programmes in the likes of the US and the UK, combined with massive amounts of fiscal and monetary stimulus, have created the conditions for a strong bull run in recent months.

FE Analytics shows the MSCI AC World index has gained 6.27 per cent over 2021 so far, with the FTSE All Share rising close to 12 per cent. Analysts expect markets to continue making ground as economies around the world open up from their coronavirus lockdowns and normal activity resumes.

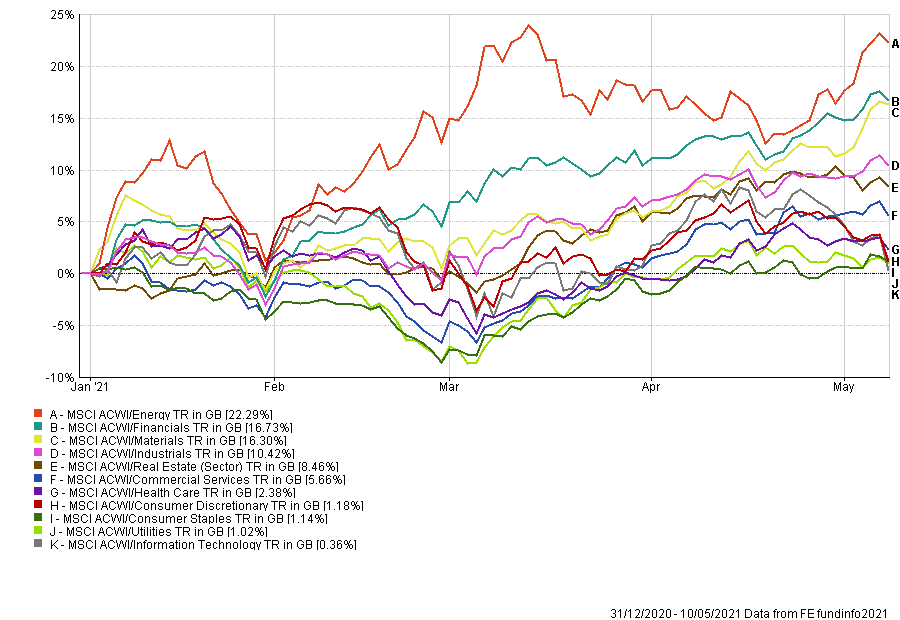

However, some areas of the stock market have been favoured more than others in these conditions. As the chart below shows, cyclical sectors like energy, financials and materials have surged in 2021 on the promise of a jump in activity, while growth and defensive sectors such as tech, utilities and consumer staples have struggled.

Performance of global sectors over 2021

Source: FE Analytics

The Investment Association (IA) recently admitted more than 500 ETFs into its fund sectors and as some ETFs take a more focused approach to industries and countries than most active funds, Trustnet ran the numbers to see if any were outpacing their average peer by a wide margin.

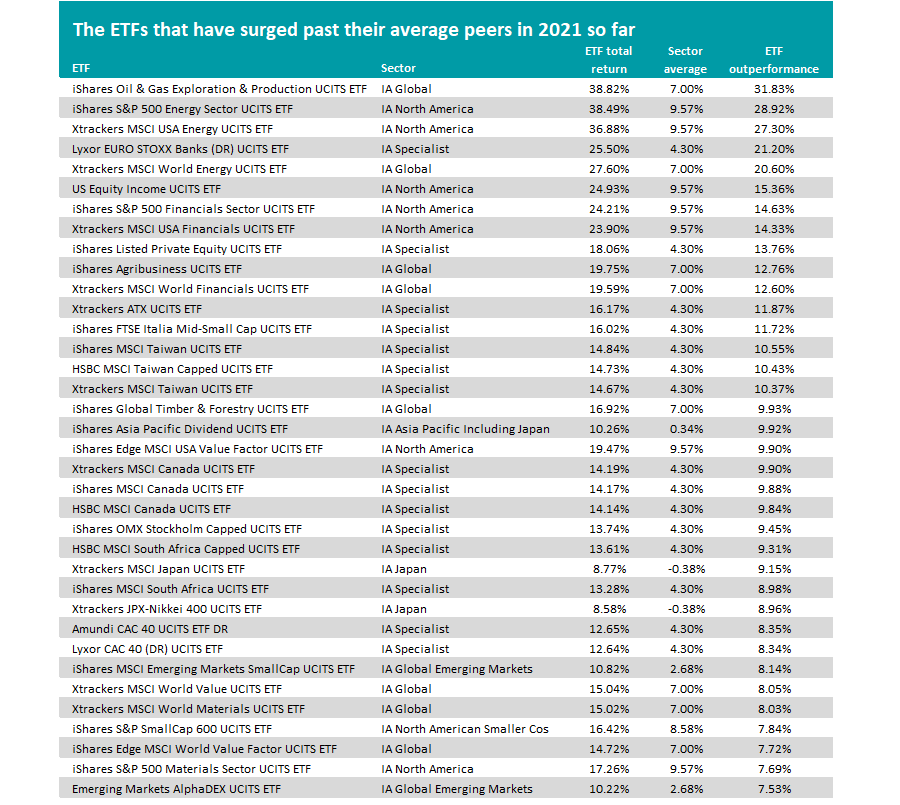

We found that several ETFs have flown past the average return of their Investment Association sector. Our data shows that five ETFs are ahead of their average peer by more than 20 percentage points while another 11 are outperforming by over 10 percentage points.

The ETF that has beaten its average Investment Association peer by the biggest margin is iShares Oil & Gas Exploration & Production.

Its total return of 38.82 per cent over 2021 so far is 31.83 percentage points higher than the 7 per cent gain made by the average fund in the IA Global sector.

Tracking the S&P Commodity Producers Oil and Gas Exploration & Production index, the ETF offers exposure to stocks that have surged in the re-opening trade as investors anticipated a jump in economic activity.

Top holdings include EOG Resources, Canadian Natural Resources and ConocoPhillips. Close to 60 per cent of the portfolio is in US stocks, with 18.7 per cent in in Canada and 9.1 per cent in Australia.

The table below reveals the 36 ETFs that have outperformed their average Investment Association peer by 7.5 percentage points or more in 2021 so far.

Source: FinXL

As noted, strategies tracking energy indices have had a strong run thanks to the reopening trade and rising commodity prices.

Indeed, the top three ETFs on that list – iShares Oil & Gas Exploration & Production, iShares S&P 500 Energy Sector and Xtrackers MSCI USA Energy – have posted the highest outperformance of any fund – active or passive – in the Investment Association universe.

But energy isn’t the only cyclical sector that has allowed ETFs to outperform their active peers, with banks rallying hard in the re-opening trade.

Banks tend to make more money in a strong economy as consumers and businesses feel more comfortable borrowing money. In addition, they benefit from longer-term interest rates rising faster than shorter-term ones, which has been happening as the market anticipates higher inflation.

ETFs that offer exposure to this and have outperformed strongly in 2021 to date include Lyxor EURO STOXX Banks, iShares S&P 500 Financials Sector, Xtrackers MSCI USA Financials and Xtrackers MSCI World Financials.

Other cyclical ETFs with strong year-to-date outperformance include Xtrackers MSCI World Materials, iShares S&P 500 Materials Sector, Xtrackers MSCI Canada, iShares MSCI Canada, HSBC MSCI Canada and Xtrackers MSCI World Value.

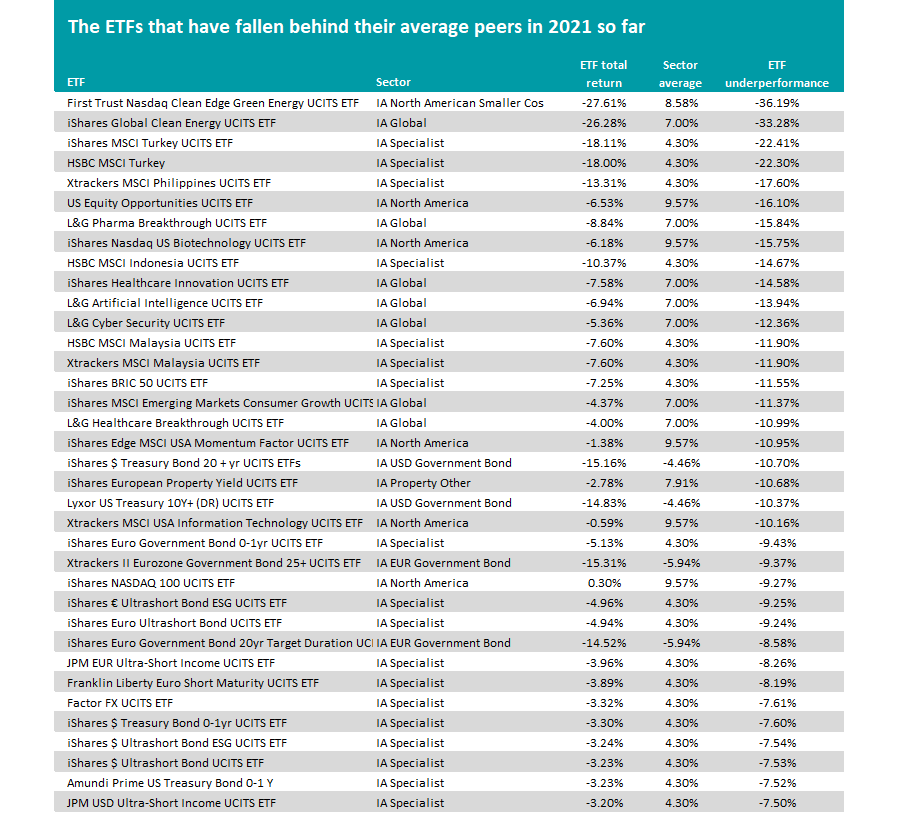

Source: FinXL

Of course, a focus on certain sectors or countries also means that ETFs can underperform by a wide margin so the above table shows all the ETFs that are lagging behind their average Investment Association peer by 7.5 percentage points or more in 2021.

Clean energy ETFs have put in the worst showing, with two ETFs concentrating on this space falling more than 30 percentage behind their average peer.

Other themes in the weakest performing ETFs include information technology, healthcare & biotechnology, government bonds and specific countries like Turkey, the Philippines and Malaysia.