European equity income strategies currently inhabit the investment sweet spot with superior yields relative to other asset classes and value that is no longer trapped, according to Argonaut Capital Partners’ Barry Norris.

Norris believes that Europe is unrivalled as the world’s top dividend and value market, suggesting it should be the biggest beneficiary of the global recovery and any inflationary period that occurs post-Covid.

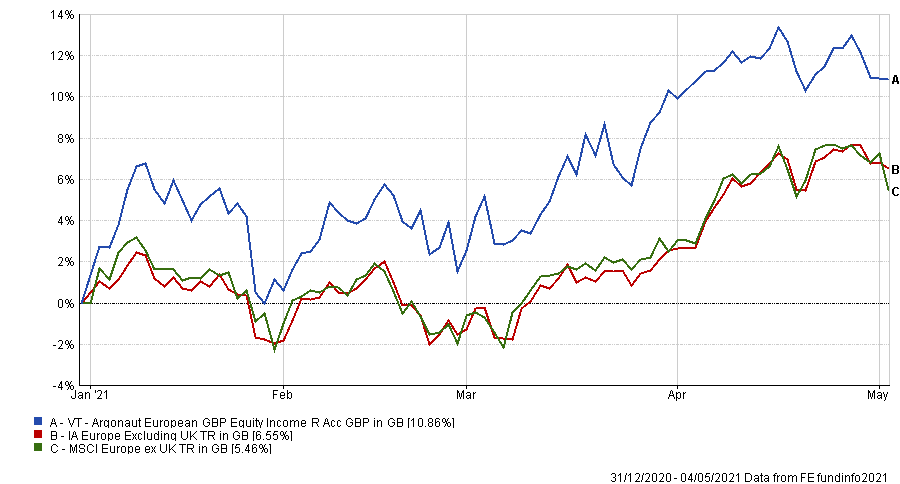

As manager of the VT Argonaut Equity Income fund, he has overseen a 10.86 per cent return year-to-date, which has so far outpaced its peers In the IA Europe ex UK sector.

Performance of fund vs sector & benchmark YTD

Source: FE Analytics

Having founded Argonaut Capital in 2005, Norris said it was his firm that launched the second ever foreign equity income fund and the first onshore one.

Norris said: “Before 2005, pretty much every income fund was just UK. However, I’d noticed that dividends were just as attractive in continental Europe as they were in the UK.”

While the UK market is seen a good hunting ground for income investors, this is not always the case – as 2020 showed when companies embarked on heavy dividend cuts to protect their balance sheets in the pandemic.

“Globally the UK has tended to underperform because of its currency,” Norris said. “But also a lot of the high dividend stocks have been in unfashionable sectors.”

Norris added that the same is true of Europe. However, since there has been a rotation to value in the latter part of 2020, the environment towards equity income strategies has changed with rising bond yields and the possibility of higher inflation.

The manager outlined that the last decade has been characterised by a deflationary boom and, since that appears to have changed recently, equity income strategies could outperform in the near term.

“Inflation hasn’t been an issue, therefore companies have been encouraged to invest in disruptive technologies and the market has thus suited long-duration equities,” he said.

It is in these growth equities, where as a shareholder, you wouldn’t get your capital back for over a decade if not longer.

Norris added: “That is why companies that have offered to pay money back to shareholders have often been seen as irrelevant or value traps.”

Therefore, what does an equity income strategy have to ensure to enjoy in this new environment?

“In order to perform well, an equity income strategy has to have higher nominal rates of economic growth and higher inflation,” said Norris.

He added that there are two aspects to this. The first being, that if there is higher economic growth, average companies can grow earnings without having to invest in disruptive technologies for growth.

Secondly, in an inflationary environment an investor would gravitate toward a low-duration bond portfolio.

“An equity income strategy is the equity equivalent of a low-duration equity portfolio and therefore equity income funds are a fantastic inflation hedge,” he said.

“I think in this inflationary boom, equity income will significantly outperform long-only equity investment styles.”

Why Europe?

Investors should therefore look to Europe due to its higher payout ratios and indices that are home to cyclicals, according to the manager.

“If we have a lot of global growth, we would return to the cycle before the financial crisis where Europe significantly outperformed the US because of its exposure to global cyclicals.”

“Europe comes into its own when there’s lots of global growth and cyclicals do well,” he added.

As an example, Norris is bullish on steel and recent events have meant companies in the industry have a fantastic amount of pricing power.

“China is reducing steel capacity because it’s trying to tackle pollution and nominally CO2 emissions,” he explained. “Cutting down emissions means shutting down production and this has also incentivised the rise of green steel.”

Indeed, the price of that green steel will be a lot higher than regular steel and this represents a clear growth opportunity within the industry.

“Plus, the overall environmental pressure from investors means there’s not a lot of new capital going into the industry in terms of new production - and this is very good for profits.”

As such, portfolio holding SSAB, a Swedish carbon steel outfit, performed strongly in March due to booming demand and its plans for future green production. This was also the case for Finnish stainless-steel company Outokumpu, another key holding.

One of the largest holdings in VT Argonaut Equity Income is Porsche, which has performed strongly so far this year owing to its investment in Volkswagen as the market reacted well to its electronic vehicle strategy.

“What we’re also seeing across the auto industry is people want their own car than to travel on public transport,” said Norris. “That’s been pretty positive on car demand in the near-term, and because production was shut down last year, inventories were also very low.”

He added that while these are just cyclical tailwinds, the market will put a high multiple on the long-term electric vehicle story.

“Because Volkswagen is now a very credible alternative to Tesla, and is trading at a much cheaper implied valuation, then if you’re bullish about electric cars, Volkswagen is your play from here.”

Performance of fund vs sector & benchmark since launch

Source: FE Analytics

Since launch, VT Argonaut Equity Income has made 50.01 per cent, while the average fund in the IA Europe ex UK sector has made 45.66 per cent and its MSCI Europe ex UK index returned 42.01 per cent.

It has an ongoing charges figure (OCF) of 0.85 per cent and a historic yield of 4.02 per cent.