UK dividend stalwarts had been destined for a payout crisis and reset for several years irrespective of the pandemic, according to Troy Asset Management’s Blake Hutchins, who believes many companies were “running on empty” before coronavirus.

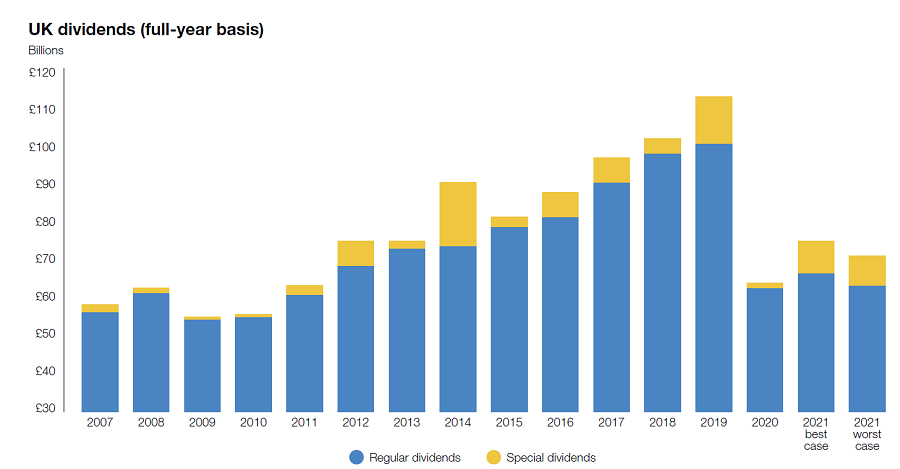

The Covid-19 pandemic had a significant impact on the UK income space, as companies were forced to slash and cancel dividends to cope with the financial impact of the pandemic.

Source: Link Group UK Dividend Monitor

But a shift in dividend culture was heading towards the UK income space irrespective of the pandemic as companies’ payouts had become more and more unsustainable, according to Hutchins (pictured).

He explained: “In the short term it's been a difficult time and equity income investors have had to kind of brace themselves over the past few years. And this was coming,” he said.

“We didn't know it was going to be because of the pandemic, but it's something we've been speaking about for many years that a lot of companies were running on empty.”

In his £2.9bn Trojan Income fund, Hutchins has a focus on companies with a cash surplus that they can use to pay dividends as well reinvest back into the businesses. This is the same thesis applied across all funds run by Troy Asset Management, putting capital preservation at the core.

But according to Hutchins, this isn’t something the biggest UK dividend payers had been doing and had made UK dividends unsustainable.

“Many businesses in the UK got to a stage where the tail was wagging the dog and the dividend was lagging and the dividend was that tail as it were,” Hutchins said.

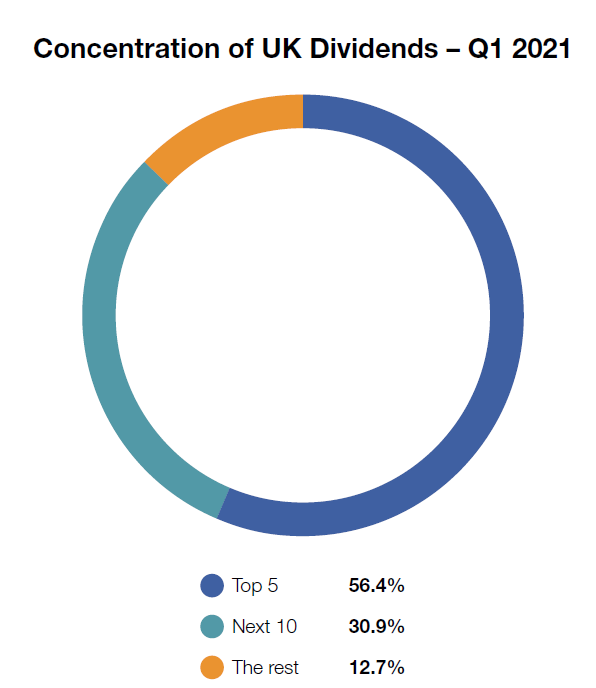

This was mainly a problem among the largest businesses in the FTSE All Share index. This created a skew where there were a few companies that accounted for a huge part of the index with this “dividend problem”, Hutchins said.

Source: Link Group UK Dividend Monitor

The manager explained that this was fundamentally a growth problem. That when a company’s growth trajectory fell it would increase its dividends - despite the stagnant cash flow – to make the business more appealing to investors.

It is not in the long- or short-term interests of businesses “to pull the dividends lever” to compensate disappointing growth, according to Hutchins.

But coming out of the Covid pandemic, it will be especially challenging to resist falling back on this method as many businesses which were struggling to grow pre-Covid will continue struggle coming out of it.

“Growth gives you that oxygen, it gives you that optionality,” Hutchins said.

“And the problem is when companies run out of growth, and suddenly your cash flows are doing zero, there's a temptation to grow your dividends above the intrinsic growth rate of your business. That's where the market tends to figure you out. And that's where you get into these dividend traps that have been all too common in the UK market.”

Applying this to his own Trojan Income fund, Hutchins said in the past 12 months he has focused on companies with “better prospects for long term dividend growth”, leading the portfolio away from stocks such as Imperial Brands, SSE, BP and Shell, which have been sold out of or reduced.

In the short term, Hutchins said companies that had fallen into these unsustainable dividend habits now have a chance to “reset” and become better long-term investments.

“As a consequence of the pandemic, and the ensuing recession that we've had these companies have taken the opportunity to reset their dividends,” he said.

“And from this tricky situation I think UK income investors and global income investors should – instead of panicking post event – really actually dividends are better set now. Okay, at a slightly lower level, but a more sustainable level and a level where companies have a better distribution between or better balance between reinvestment and paying dividends.

“So actually, in the short term, I feel pretty good about the kind of capital allocation and the ability for dividends to be quite well funded and for companies to pay down some debt, etc.”

But looking further ahead, while there is a chance for the UK to alleviate some of the aforementioned issues of unsustainable yields and dividend concentration risk, Hutchins said he was worried about firms falling back into bad habits.

He said: “Longer term, we all know that things can revert back to their old ways.

“And that's where I think it's important for us as income investors to send the right messages to companies to act in the long-term interests of us and our investors, to make sure that they continue to find that balance between income and retaining cash flow in order to deliver better total returns for our investors.

“Because there's no point - and you can see this in too many companies in the UK - there's no point delivering big dividends and then delivering a negative share price. You've seen these companies that are basically going sideways or backwards and they're paying large dividends. And so for us, our returns have been dividend yield minus capital.”

In conclusion Hutchins said: “Short term I’m feeling pretty good about it [the UK income market]. But longer term we have to make sure that our companies continue to act and allocate capital in the right way. Because they don't always do that and they don't always hear the right messages from income investors.”

Hutchins joined Troy Asset Management at the end of 2019 and has been a co-manager on the Trojan Income since last year. He runs the fund with FE fundinfo Alpha Manager Francis Brooke and Hugo Ure.

Over the past five years the fund has made a total return of 22.15 per cent, underperforming against both the FTSE All Share index (41.06 per cent) and the IA UK Equity Income sector (31.39 per cent).

Performance of fund vs sector and index over 5yrs

Source: FE Analytics

With an FE fundinfo Crown Rating of four, the fund has a yield of 2.8 per cent and an ongoing charges figure (OCF) of 1.01 per cent.