The FTSE 100 index has hit its highest level since the coronavirus crash over a year ago as industrial, banking and mining stocks all made gains on Friday.

The blue-chip index of stocks hit the landmark in early trading this morning in response to a sustained UK recovery, buoyed by an impressive vaccine rollout and greater clarity over Brexit.

It is now about 40 per cent higher than its low point in March 2020 - when it dipped below 5,000.

Performance of FTSE 100 YTD

Source: Google Finance

Adam Vettese, analyst at multi-asset investment platform eToro, said: ““With the vaccine roll-out fairly advanced and talk positive about the future state of the economy, investors are once again seeing opportunity rather than threat in UK shares.

“The FTSE 100 is often derided for its ‘old world’ constituents, but it is these miners, banks, oil companies and airlines that will power the recovery and investors are beginning to wake up to that.

Despite the recent rally, the UK has lagged its global peers in the recovery, although continues to look very attractive compared to the US and European markets, trading on a 40 and 25 per cent discount respectively.

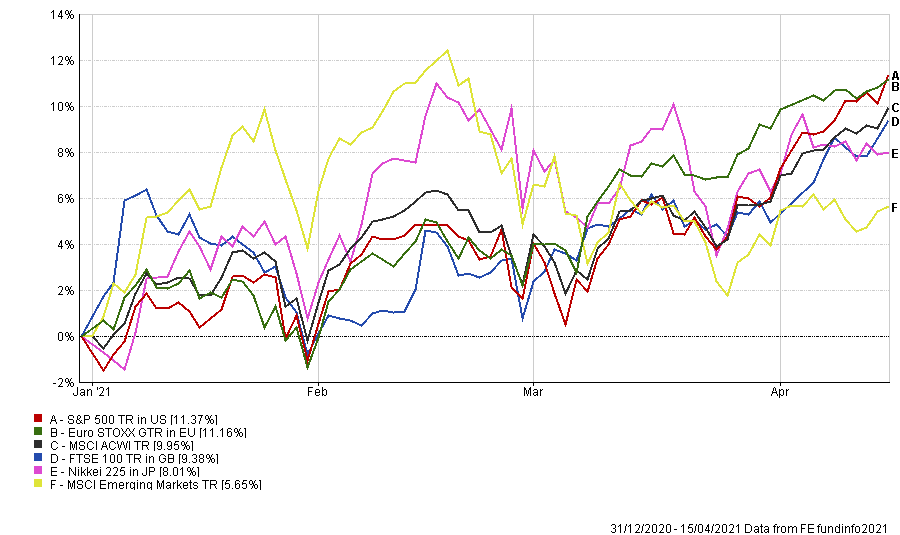

Performance of global indices YTD

Source: FE Analytics

Jonathan Winton, portfolio manager of the Fidelity UK Smaller Companies fund, added: “The UK continues to be one of the lowest rated markets globally, despite a relatively favourable economic growth outlook and greater Brexit clarity.

“Encouragingly, many UK companies are reporting strong trading whether they’re domestically or internationally exposed, and in that context, it’s hard to see why the UK discount should persist.

He finished: “While the FTSE 100 continues to be a laggard in international terms, the fact it has broken through the 7,000 mark for the first time since February last year can be read as a sign of cautious optimism among investors.”