Investors who are uncertain on if they should favour growth stocks over value, large-caps over small-caps, or any other number of asset allocation choices could look for funds where the manager makes many of these decisions, according to Chelsea Financial Services’ ISA season fund picks.

Deciding where to invest can often be a difficult decision and one that has been compounded by the uncertainty of the global recovery.

Darius McDermott, managing director of Chelsea Financial Services, said: “Decision making can be difficult and fraught with consequences at the best of times, but it appears lockdown has also made our decision-making worse than usual.

“So if it's indecision that is stopping investors from using their ISA allowance this year, it’s understandable – the choice of funds available is huge and it's hard to know whether markets are getting ahead of themselves or if we’ve just begun another lengthy bull run.”

With that, below are Chelsea Financial Services’ six funds that could help an investor that may be suffering from selection indecision.

Growth or value?

The first choice is whether buy growth stocks or value stocks, which have recently seen a reversal in fortunes, and McDermott highlighted the $4.5bn T.Rowe Price Global Focused Growth Equity fund, run by FE fundinfo Alpha Manager David J. Eiswert.

“The manager usually has a growth style and he will take advantage of mispriced growth too,” said McDermott. “He also told us last year that value would have its day and it has and he has performed well in the growth environment but also during the recent value rally.”

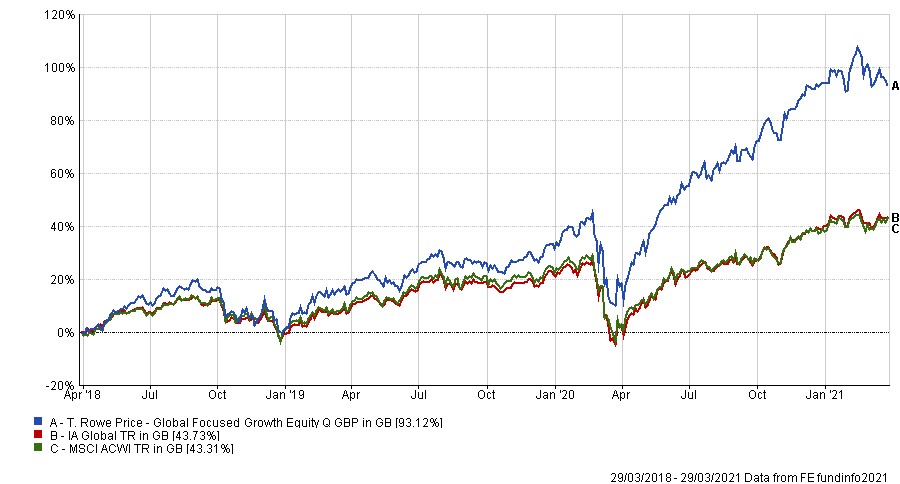

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Over three years, the five FE fundinfo Crown-Rated fund has made a total return of 93.12 per cent, while the IA Global sector peer has made 43.73 per cent and the MSCI ACWI returned 43.31 per cent.

It has an ongoing charges figure (OCF) of 0.88 per cent.

Large, medium or smaller companies?

For investors unsure of which size companies to opt for, McDermott has recommended Marlborough Mutli-Cap Growth. The £283.6m fund invests in UK companies of varying sizes depending on where the opportunities can be found.

Headed up by FE fundinfo Alpha Manager Richard Hallett, the portfolio is concentrated in around 50-70 holdings, principally those that are leaders in their sector and that can grow regardless of the prevailing economic landscape.

Performance of fund vs sector over 3yrs

Source: FE Analytics

Over three years, Marlborough Multi-Cap Growth has made 21.43 per cent, while the average fund in the IA UK All Companies sector made 14.45 per cent.

It has an OCF of 0.81 per cent.

Developed or emerging markets?

The third option is the £3bn Fidelity Global Special Situations fund, also run by an Alpha Manager -Jeremy Podger. This could be a choice for those who can’t decide between developed and emerging markets.

“The fund invests predominantly in larger companies and the manager uses the breadth of Fidelity's global research team to highlight what he sees as being the best ideas from all around the world,” said McDermott.

“Holdings fall into one of three categories, forming a blended portfolio that can deliver consistently through all market conditions,” he added.

According to FE Investments, those three categories are companies that are exceptionally undervalued, ones that have unique franchises that can grow their earnings faster than their peers and those undergoing corporate change that could be the catalyst for share price growth.

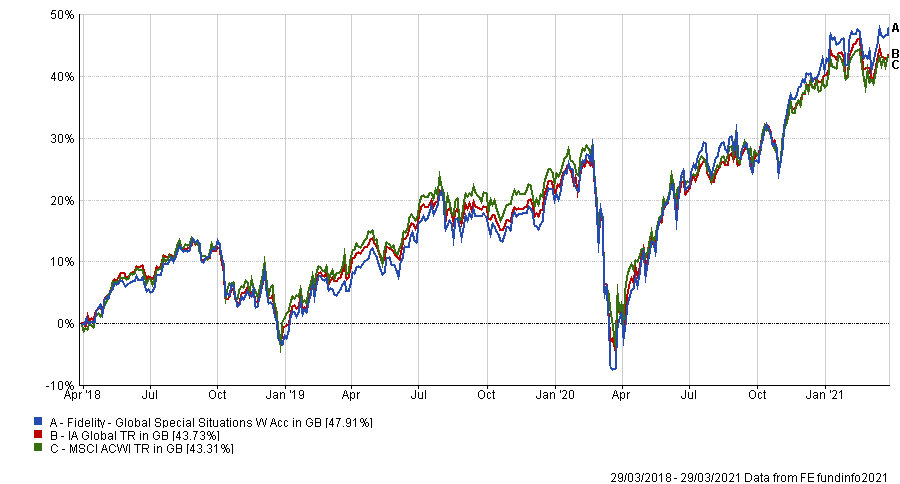

Performance of fund vs sector & benchmark over 3yrs

Source: FE Analytics

Fidelity Global Special Situations posted a total return of 47.91 per cent over three years, compared to 43.73 per cent for the average fund in the IA Global sector and 43.31 per cent for the MSCI ACWI. It has an OCF of 0.92 per cent.

Which way will the stock market go?

The future direction of the stock market is an ever-present concern for investors, but might seen especially uncertain today with the coronavirus pandemic, signs of inflation and worries about overvaluation.

As such, McDermott has opted for the Janus Henderson UK Absolute Return strategy, run by Alpha Managers Ben Wallace and Luke Newman.

The fund can benefit from both rising and falling share prices, which helps to limit the volatility and potential loss of the fund compared to an equity investment.

The £1.4bn fund is what’s known as a long/short targeted absolute return fund and aims to achieve a positive absolute return for investors regardless of market conditions.

Performance of fund vs sector over 3yrs

Source: FE Analytics

Janus Henderson UK Absolute Return made 7.37 per cent over three years, compared to 5.40 per cent for the IA Targeted Absolute Return sector as a whole. It has an OCF of 1.07 per cent.

Government or corporate bonds?

For investors unsure about this one, McDermott recommended Invesco Monthly Income Plus, which he said has a flexible mandate to invest in any type of bond.

“It was designed to offer investors broad exposure to the UK fixed income market and provide a high level of income, paid monthly,” he said. “The fact that the fund can, and often does, have a 20 per cent allocation to equities is a genuine differentiator.”

The £2.3bn fund is run by Paul Causer, Ciaran Mallon and Rhys Davies.

According to Rayner Spencer Mills Research, for investors willing to accept a higher degree of risk, the fund offers an alternative and diversified income source.

While bond coupons will provide most of the income, equity dividends can offer an alternative source of a growing income.

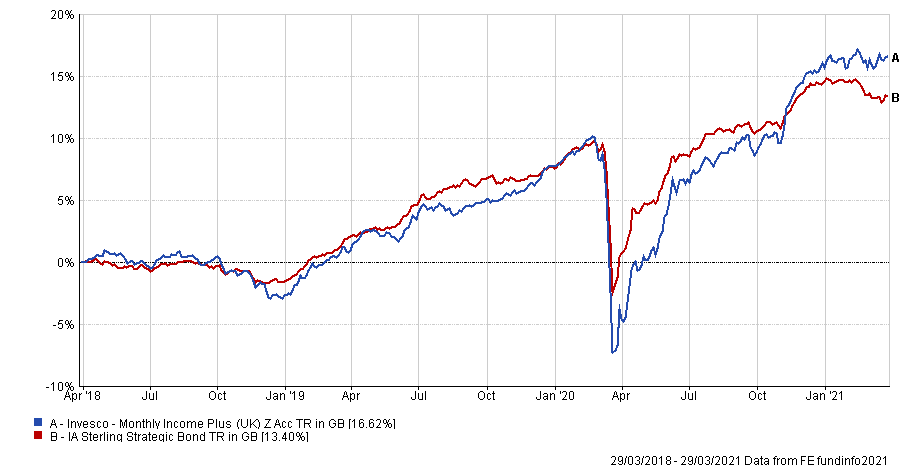

Performance of fund vs sector over 3yrs

Source: FE Analytics

Over three years, Invesco Monthly Income Plus made a total return of 16.62 per cent, while the average IA Sterling Strategic Bond sector peer made 13.40 per cent. It has an OCF of 0.72 per cent.

Asset class?

The last fund chosen by Chelsea Financial Services is one from his company’s own stable and invests across the board: the £31.5m VT Chelsea Managed Balanced Growth fund.

“The strategy is a fund-of-funds that has a target weighting of between 50 and 70 per cent in UK and overseas equities,” said McDermott.

“However, it will also invest in other assets including bonds, property, gold and targeted absolute return strategies, depending on where the investment team thinks it can find the best opportunities.”

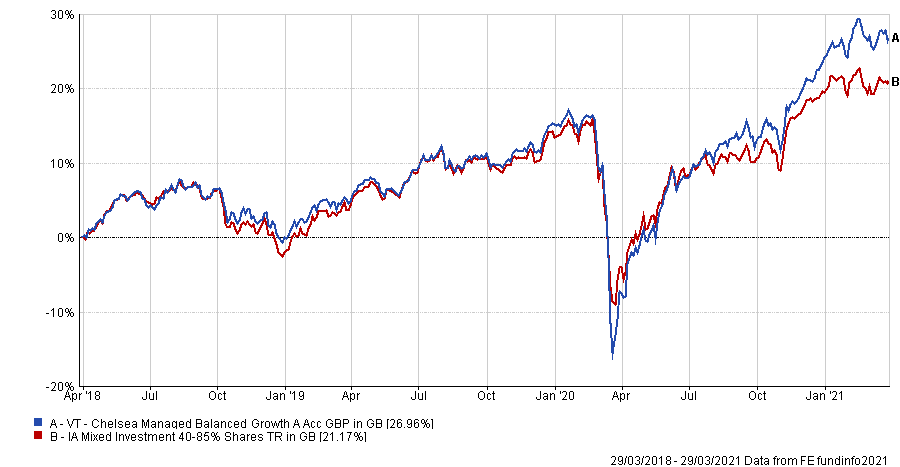

Performance of fund vs sector over 3yrs

Source: FE Analytics

Over the same period, Chelsea Managed Balanced Growth returned 26.96 per cent against 21.17 per cent for the IA Mixed Investment 40-85% Shares sector.

It has an OCF of 1 per cent.