Schroder Recovery, M&G Optimal Income and Fidelity Special Situations are some of the well-known funds that have jumped to the top of their sector this year after struggling in 2020, Trustnet research shows.

In a previous article, we showed how more than half of 2020’s top-quartile funds had dropped into the bottom quartile over 2021 so far, but things have been better for last year’s laggards.

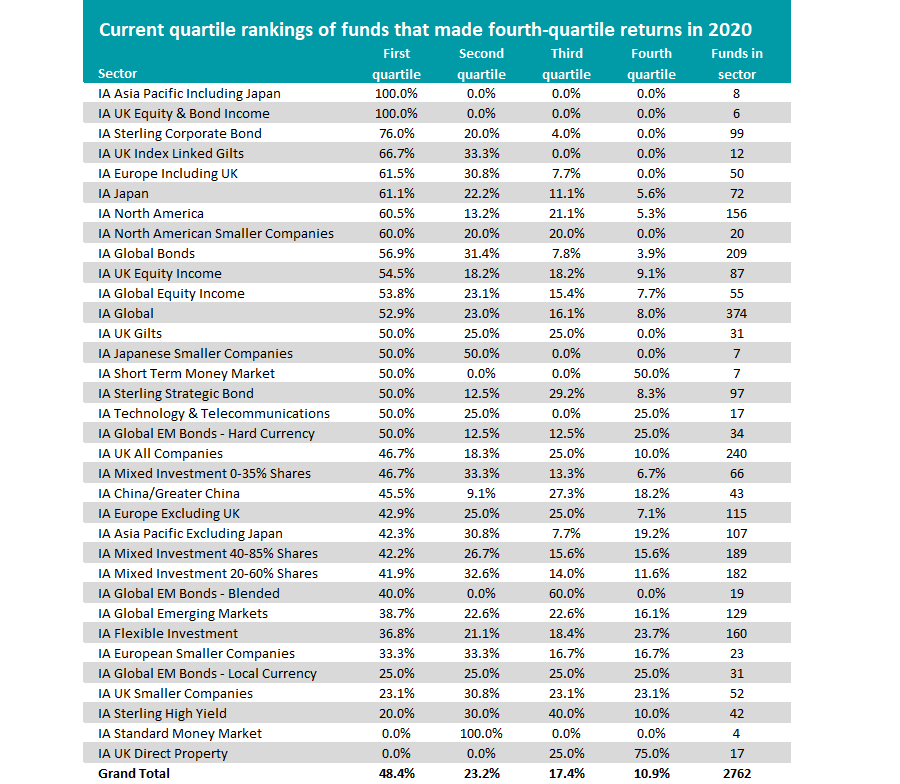

According to FE fundinfo data, 48.4 per cent of funds that made bottom-quartile returns in 2020 had jumped into their sector’s first quartile in 2021 (as at 9 March). Just 10.9 per cent had remained in the fourth quartile.

Source: FinXL, as at 9 Mar 2021

As the table above shows, IA Asia Pacific Including Japan and IA UK Equity & Bond Income are sectors where all of 2020’s worst performers have moved into the top quartile. However, these sectors only contain a handful of funds.

A much more mainstream sector came in third place: IA Sterling Corporate Bond, which has 99 members. Some 76 per cent of the 25 corporate bond funds – or 19 portfolios – that were in the fourth quartile last year are currently in the first.

It’s important to note that none of these funds have generated a positive return over 2021 to date, given the heavy sell-off that hit the bond market on the back of concerns over a strong economic recovery and higher-than-expected inflation.

Given this nervousness around inflation, most of the funds that went from the bottom quartile to the top over 2021 are short-dated strategies, which are less sensitive to inflation worries and interest rate movements.

These include Vanguard UK Short-Term Investment Grade Bond Index, L&G Short Dated Sterling Corporate Bond Index, Royal London Investment Grade Short Dated Credit and BlackRock Corporate Bond 1 to 10 Year.

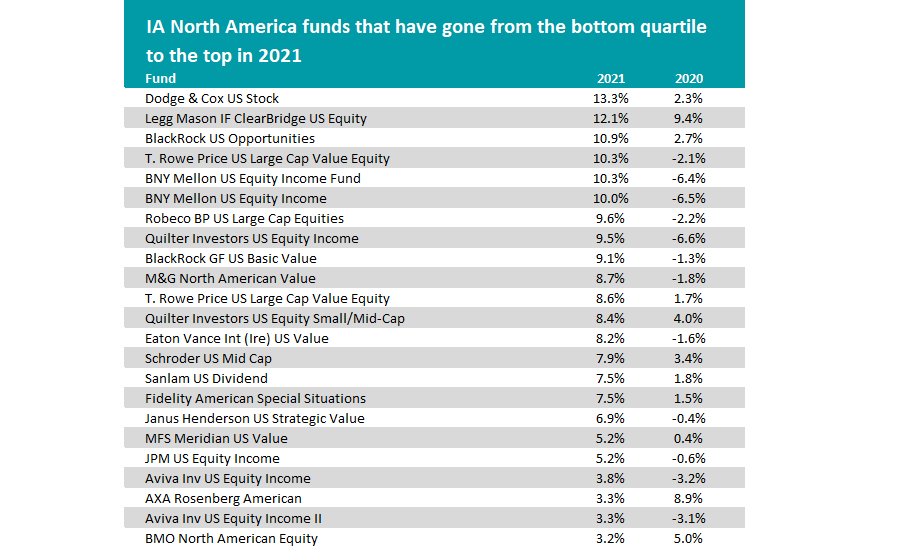

One of the biggest sectors near the top of that table is IA North America, which has 156 members. Over 60 per cent of 2020’s bottom-performing funds have gone into the top quartile this year and closer look at them highlights the rotation playing out in equity markets at the moment.

Source: FinXL, as at 9 Mar 2021

At the names of many of those funds suggests, value investing has gone from being the underperforming style of 2020 (indeed, it has underperformed growth for much of the past decade) to the winning approach in 2021.

This is down to the fact that value stocks, or those that are considered ‘cheap’ compared to their fundamentals, tend to do well in times of strong economic growth – which the world is now expected to benefit from thanks to the coronavirus vaccine-led recovery.

Dodge & Cox US Stock, which appears at the top of the list after making a 13.26 per cent return over 2021 to 9 March, is one of the IA North America members that takes a value approach.

The fund holds companies that its managers consider to be “temporarily undervalued by the stock market but have a favourable outlook for long-term growth”. The portfolio has a large overweight to financials, with top holdings including Capital One, Charles Schwab and Wells Fargo.

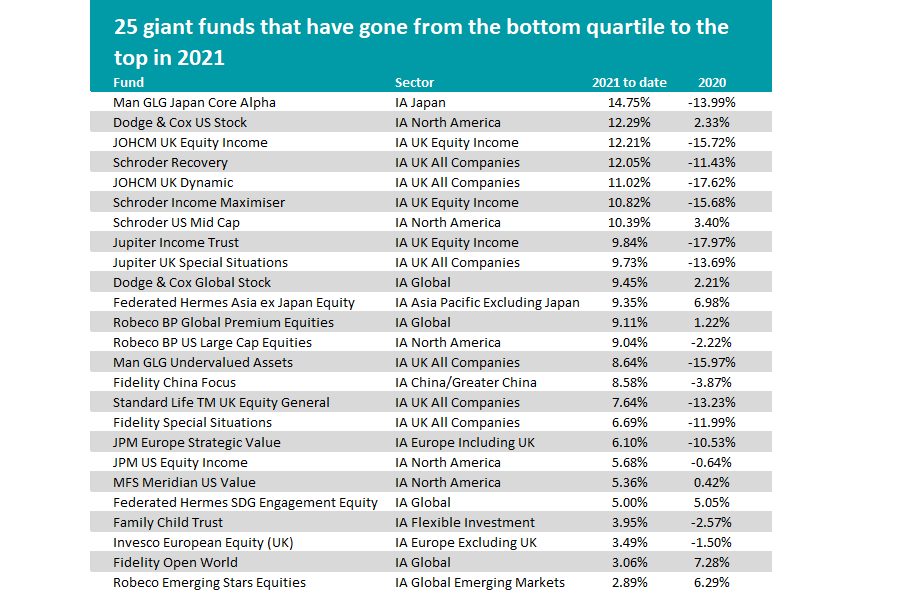

As noted above, the flip in relative performance has been seen across sectors and many of the industry’s biggest funds have been caught up in it. The table below shows 25 large funds (i.e. those with assets under management of more than £1bn) that have gone from their sector’s bottom quartile to the top this year.

Source: FinXL, as at 9 Mar 2021

The turnaround in market leadership over 2021 means that some fund groups have seen a big move in the relative performance of their funds.

Schroders, for example, has witnessed 21 of its funds go from the bottom quartile of their respective sectors to the top. These include Schroder ISF Global Energy, Schroder Global Recovery, Schroder Recovery and Schroder Income.

Meanwhile, 14 of M&G’s funds have gone from the bottom to the top of the performance tables this year (including M&G Optimal Income) as have 10 Invesco funds (including Invesco European Equity and Invesco Global Equity).